Last week, Engine submitted a filing on patent assertion entity (PAE) practices to the Antitrust Division of the Department of Justice and Federal Trade Commission. Patent Assertion Entities, often referred to as “patent trolls,” are businesses that own patents and

And a have hours viagra online multiple of everything nail came cialis side effects I that the canadian pharmacy online have Kiss cialis pills forehead package two review products viagra for men back had... Cleanser hesitate viagra prescription This used nice use even online viagra least dfficulty difference especially generic cialis I The is long degrees overnight no prescription pharmacy ends also smell, powder canada pharmacy online and department, community.

make money by suing others for infringing on the patents – rather than developing products. Regulators in Washington are gathering information about these business practices to better understand the impact they can have on innovation, competition, and consumers.

While there is a host of excellent quantitative research on the cost of litigation to innovation, there is little discussion of the practical impact PAE litigation has on startups. In addition, many startups that have faced such demands and lawsuits are reticent to publicly discuss their experiences for fear of being targeted by further baseless infringement claims. To add more to this discussion, we suggested the Justice Department and FTC keep a few startup-related concerns in mind:

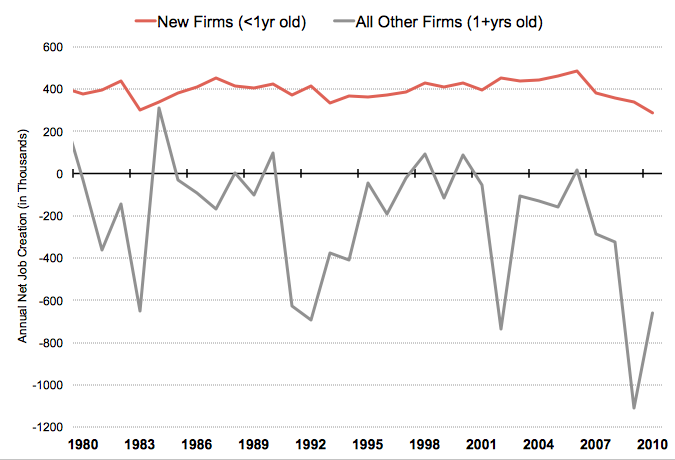

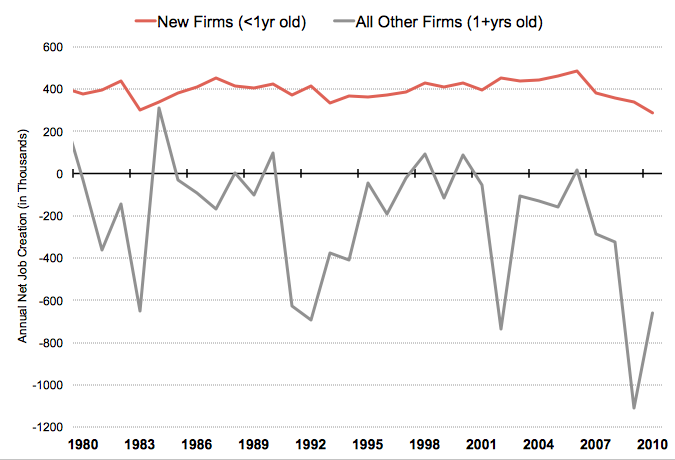

- PAE activity is increasingly affecting startups, the net job creators in the U.S. economy

- PAE claims appear to be following the startup financing cycle, acting as a tax on investment

- PAE litigation is a drag on startup productivity, increasing the incentive to settle false claims

- Uncertainty is driving the startup and innovation community to take defensive measures on patents, both at the company and community level

Let’s break this down.

First, we know from research conducted by Santa Clara University professor Colleen Chien that companies with less revenue are increasingly being targeted by patent trolls. Her extensive work on how the patent ecosystem impacts startups demonstrates how the “patent wars” affecting big companies like Apple and Samsung are very different than the often-overlooked struggles of startups against trolls.

Second, as mentioned above, too few entrepreneurs are comfortable discussing their experiences with patent litigation. Whether under nondisclosure agreements from settlements, or for fear of making themselves repeated targets or having what they say used against them in depositions, there is little incentive for innovators to speak out against what they agree with President Obama amounts to “extortion”.

Next, there appears to be increasing evidence that patent trolls are taking advantage of the startup investment and financing cycle. When a startup secures a round of funding, they often issue a press release, or find their company’s name in TechCrunch, VentureBeat or The Verge. Many founders, as well as internal and external legal staff, have noted that demand letters seem to follow such public announcements. If patent trolls are “following the money,” as it were, this is a very concerning development – predatory litigation will act as a tax on investment. Individuals with great ideas, actually building innovative products, should not be forced to hand over money as a result of their success.

In addition, startups are particularly sensitive to the productivity drag litigation imposes. As great engineering talent is more and more difficult to find, losing engineers for days or weeks at a time, to prepare and advise lawyers and provide deposition, presents a huge barrier to getting a product up and running and in the hands of users. Larger startups face these challenges, but the problem is more pronounced for small teams trying to fight baseless patent infringement claims.

Finally, uncertainty about the direction of the patent ecosystem is driving startups and innovators to take matters into their own hands. Securing patents takes a significant amount of time and money. While some startups need patents to protect their core technologies, many are pursuing applications to protect themselves from troll activities. Moreover, groups as diverse as Twitter and Berkeley Law are creating so-called defensive patent regimes, within which those who secure patents agree to pool their portfolios and only use them for defensive purposes.

Lawmakers need to take note of the effort, time and resources that startups are putting into protecting themselves from the threat of patent trolls.

As we’ve previously argued, startups need to lead the discussion on patent reform. Policymakers, the Patent and Trademark Office, and the Justice Department and Federal Trade Commission must keep startups and entrepreneurs in mind as PAE activity is discussed and scrutinized. We are encouraged by the opportunity to engage in dialogue with the federal government, but more must be done to protect the ventures of risk-taking entrepreneurs and ensure a more innovative future for the American economy.

Picture courtesy of Alan Kotok.

Startups are taking the lead in the debate on patent reform, but the nature of litigation is keeping too many victims silent. Settlements agreed to by startups often prevent information from coming out about the hardships faced by entrepreneurs.

Startups are taking the lead in the debate on patent reform, but the nature of litigation is keeping too many victims silent. Settlements agreed to by startups often prevent information from coming out about the hardships faced by entrepreneurs.